From Level 2/3 to CEDP: Navigating Visa’s New Era of Enhanced Commercial Data

At this week’s ETA Payment Facilitation Committee meeting, we’ll take a deep dive into Visa’s new Commercial Enhanced Data Program (CEDP), a fundamental shift now in active enforcement. CEDP retires the Level 2, Level 3, and Large Ticket programs and replaces them with a unified, data-driven framework designed to reward accuracy, consistency, and completeness of enhanced data on commercial and small-business card transactions.

It’s Just Not the Same Game

When my career first began in Acquiring, we simply sold electronic payments to merchants who were otherwise just focused on cash and checks. It was a reasonably easy business. But, as an industry, we’ve never really stood still for long.

Acquiring Industry Enters a New Phase of Structural Change

Acquirers will need to pivot from purely “processing” to “platform + value-added services (fraud, data, embedded payments)” if they want to maintain margins. We have a lot to consider in this past moving industry and economy.

Fintech Charters on the Rise

2025 may well become the year of the charter in fintech. According to various reports, more than twenty applications from fintechs and non-bank players have been filed this year alone for new bank charters, conversions or acquisitions. This is an all time high.

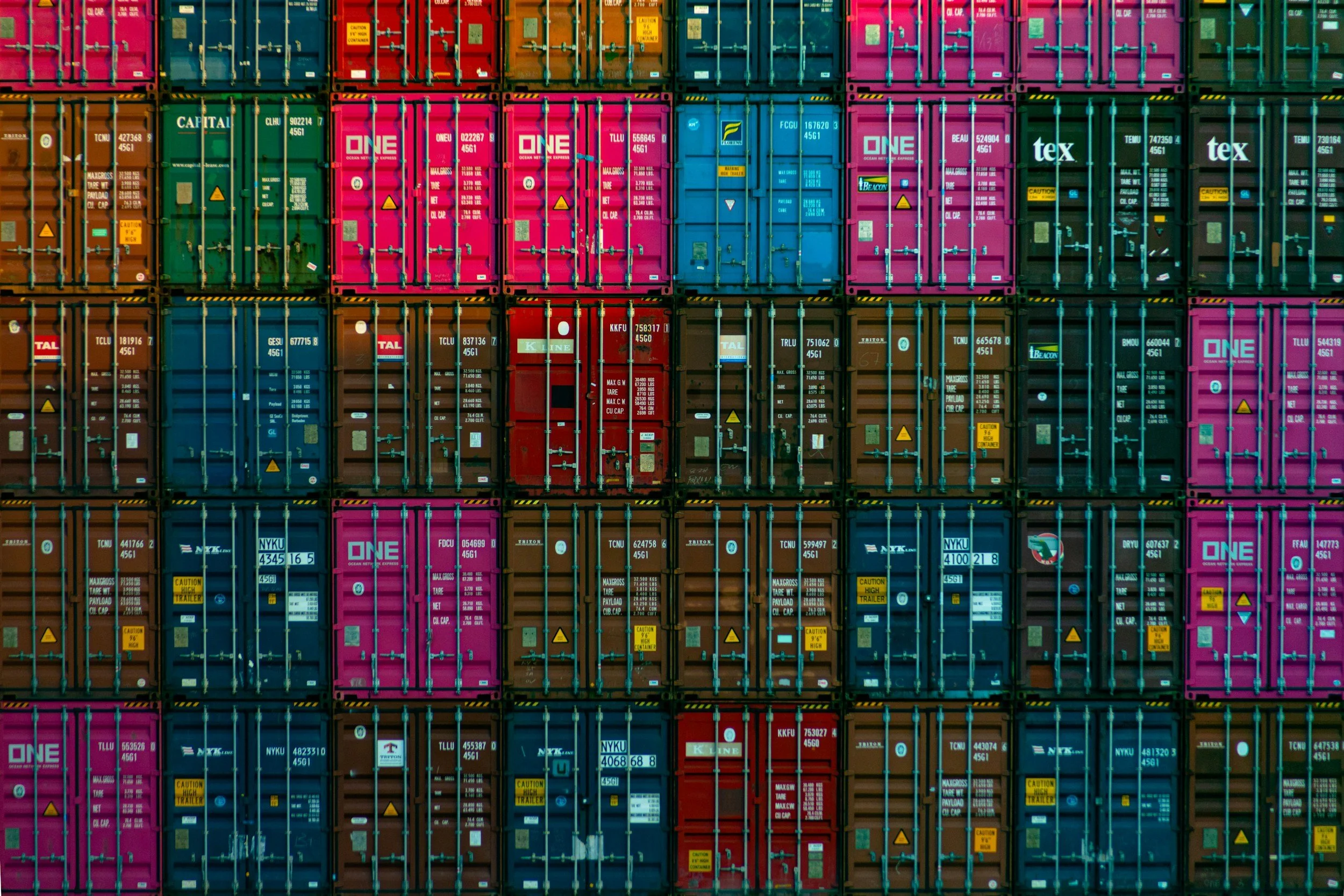

Can Acquirers Help Merchants Assess Tariff Costs?

The acquiring industry has long focused on payments, yet its data holds untapped potential for trade intelligence. By integrating SKU-level information, country-of-origin data, and tariff schedules, acquirers could offer merchants tools to model “landed cost” scenarios. This would show how tariffs affect profit margins or pricing strategies. Think of it as a new kind of risk dashboard, where payment analytics meet supply-chain foresight.

Financing the Rails

Ramp surpassing $1 billion in annualized revenue is a milestone not just for corporate cards, but for the broader trend of embedded commercial credit woven into merchant ecosystems. On the crypto side, Kraken’s $500 million raise and ZeroHash’s $104 million round show investor conviction in custody and exchange services that will inevitably intersect with merchant acceptance and settlement. And if Tether succeeds in raising $15–20 billion at a $500 billion valuation, it could accelerate the adoption of stablecoin settlement in acquiring portfolios.

A Practical Guide to Visa Commercial Enhanced Data Program (CEDP)

It is a program that will define how merchants and payment processors can reduce interchange costs by adhering to Visa’s new data standards. Visa will now require merchants to be validated for the integrity and accuracy of their data passed when a commercial card is being used (B2B transactions) to benefit from the savings. Generally speaking, the metrics Visa is looking for are sales tax information (Level 2) and product information (Level 3).

Congratulations to Basis Theory on Their Strategic Partnership with Mastercard

Big news in payments innovation: Mastercard and Basis Theory have announced a strategic partnership designed to advance agentic commerce. A significant next-generation approach that combines AI-driven intelligence with secure, flexible payment infrastructure. This collaboration represents a significant step forward in shaping how businesses and consumers will interact in a more personalized, efficient, and secure commerce environment.

RPY Innovations Makes Connections. Just Call Us the Matchmaker

In payments, growth often comes down to connections and relationships. We are engaged in a complex and sensitive business. Linking the right merchants with the right platforms, matching risk appetite with the right compliance framework, and aligning strategy with the right technology are all vitally important for success. At RPY Innovations, we’ve spent more than 15 years helping acquirers, payment facilitators, ISVs, and merchants make those connections with confidence.

The New Era of Commercial Payments: Navigating Visa's CEDP

Companies processing B2B transactions need to pay close attention to Visa's upcoming changes with the introduction of the Commercial Enhanced Data Program (CEDP).